Online auction house, Grays, reduced collections staff by 80% and improved collection rates by 30% using Upwire SMS, email and NanoSites™

CHALLENGE: Close the loop on lapsed credit cards and reduce manual collections

Due to the infrequent nature of purchases from GraysOnline, over 10% of customers’ stored credit cards are lapsed when they win an online auction. When auctions close, collections staff are needing to be taken from core work to telephone failed transactions and collect new credit card information.

Staff cannot take credit card details over the phone (due to PCI compliance regulations) so had to walk customers through updating the credit card remotely while also remaining on the call. This manual process was resource-intensive (expensive), caused customer frustration, and extended payment collection dates. Ultimately resulting in lost sales.

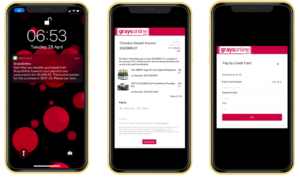

UPWIRE SOLUTION: Automate communications to enable “self-serve” card updates

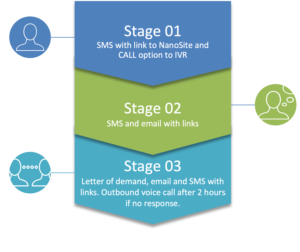

Upwire designed a three-stage, seven-day collections communication workflow for Grays, with escalating messages and channels. This automated the process and provided options to customers and staff.

• GraysOnline integrated their ERP system with Upwire using our standard API

• Upwire integrated with Braintree API

• Customers can choose credit card, PayPal, EFT

• The system automatically re-calculates surcharges if there is a change due to type of payment choice

• If staff are involved they can transfer customers into the IVR instead of walking them through the process remotely

RESULTS: Exceptional outcomes. Fast.

The Upwire payment solution outreach achieved results far surpassing the more expensive contact centre outreach:

• Immediate revenue uplift: 30% of SMS recipients click through from the first SMS and pay via the NanoSite. An overall 30% increase in revenue was the result.

• Improved process: the self-service SMS-NanoSite communications workflow means a simplified process for both staff and customers

• Reduced overheads: An 80% reduction in FTEs. Staff no longer need to be involved in credit card update transactions, resulting in a huge time and operational cost saving

• Improved customer experience: Convenient, timely communications make it easy for customers to update details and complete their payment transaction

In summary the results increased revenue, reduction in operational costs and a better customer experience These are the exceptional outcomes Upwire delivers.

If you would like to discuss the how Upwire can help deliver extraordinary results across your organisation’s onboarding, payments or retention communications – please get in touch. We’d love to chat.